- Written by - Phil Cuming

First impressions matter. Picture the following scenario.

You’re going for a job interview at a prestigious private equity firm for your dream job. However, when you sit down for the interview with your potential future line manager, it turns out he hasn’t read your CV and keeps calling you the wrong name.He proceeds to spend the next hour asking you the same questions repeatedly, then insists you fill in a stack of application forms he somehow manages to lose that same day, then texts you later that night to ask you to fill them in again and mail them back.

It’s hard to imagine a first impression going that badly. And yet it happens all the time when new clients are onboarded by financial services organisations.

All too often, businesses fudge the client onboarding experience by:

- Asking for the same information repeatedly

- Insisting on physical documents and manual processes

- Not doing proper background and compliance checks

And yet, for every financial services organisation making clients fumble their way through frustrating onboarding processes, there’s one using a solution like Salesforce Financial Services Cloud to create frictionless onboarding experiences that new clients remember for all the right reasons.

Here’s how organisations like this one use Salesforce Financial Services Cloud to ace the client onboarding experience.

CRM-Enhanced Onboarding

The notion of creating a 360-degree view of your customers is hardly a new concept, and yet so many businesses struggle to get this right.

The 5 most common reasons why they struggle to create a 360-degree view include the following usual suspects:

Data Silos – Different departments (e.g., sales, customer service, compliance) often store customer data in separate, unconnected systems, making it difficult to unify this information into a single, comprehensive view.

Legacy Systems – Financial institutions frequently rely on outdated technology and infrastructure, which can be incompatible with modern data aggregation tools, limiting the ability to integrate data from various sources.

Incomplete or Inconsistent Data – Customer information is often incomplete or entered inconsistently across systems, leading to gaps in the customer profile. This can occur due to manual data entry errors or outdated records.

Regulatory and Compliance Constraints – Strict regulations in the financial services industry can limit how customer data can be shared or accessed across departments, hindering a unified view of the customer.

Fragmented Customer Journeys – Customers interact with financial institutions across various touchpoints (mobile apps, websites, branches, call centres), and these interactions are not always tracked or consolidated, making it harder to fully form a picture of customer behaviours and preferences.

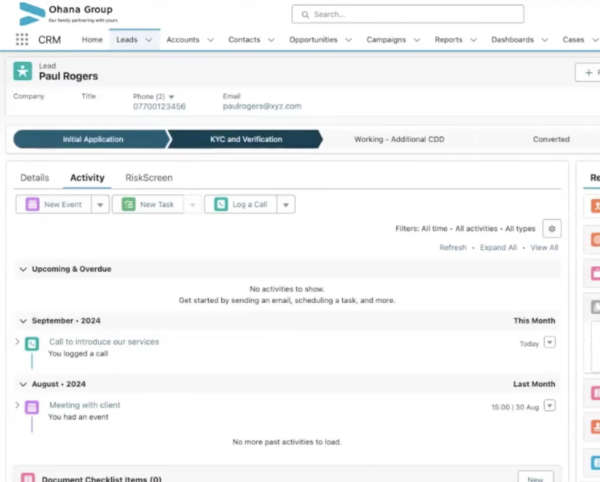

By integrating your CRM data with the client onboarding process, Salesforce Financial Services Cloud consolidates all the information you already have in your system for a given client and presents it as follows:

At a glance you can see information like:

- Which stage the lead is at in the onboarding flow

- Past activity anyone at your company has had with that customer

- Full history of calls, meetings and emails

- Gaps in existing information

This allows you to quickly identify and clear roadblocks in the onboarding process and streamline the customer onboarding journey across channels.

The Art of the Action Plan

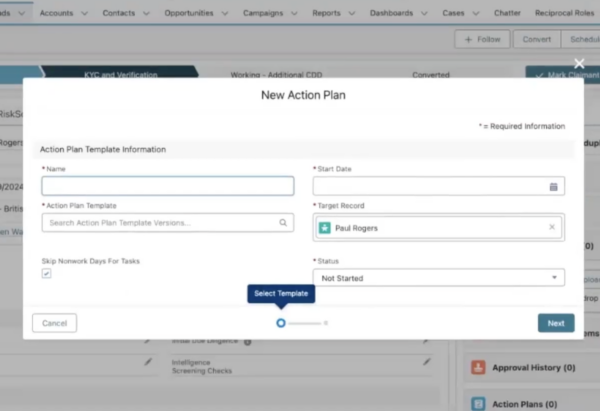

Action Plans are an out-the-box feature of Salesforce Financial Services Cloud that allows you to create a series of tasks and events specifically around different topics.

Simply put, they are a godsend for streamlining and removing friction from the onboarding process.

When onboarding a new client, you can apply a pre-built Action Plan template. This automatically generates tasks and document requests, tracking every required step.

Action Plans let you assign tasks to team members, ensuring everyone handles their part. For multi-jurisdictional work, different templates ensure the right documents are requested based on regional compliance requirements.

Beyond onboarding, Action Plans turn Salesforce into a powerful task and workflow management system, all within the context of specific clients. This allows your team to manage tasks more efficiently and personally.

In short, Action Plans simplify and automate onboarding whilst ensuring compliance throughout the customer onboarding journey.

Delivering Seamless Due Diligence

If you’ve ever nurtured a prospect for months (or years) only to be told by compliance or your onboarding team that you can’t work with them, what you’re about to read could save you from ever experiencing that pain again.

One of the beauties of Salesforce is the Salesforce App Exchange where you can download and install third party apps which include a number of KYC and Verification apps.

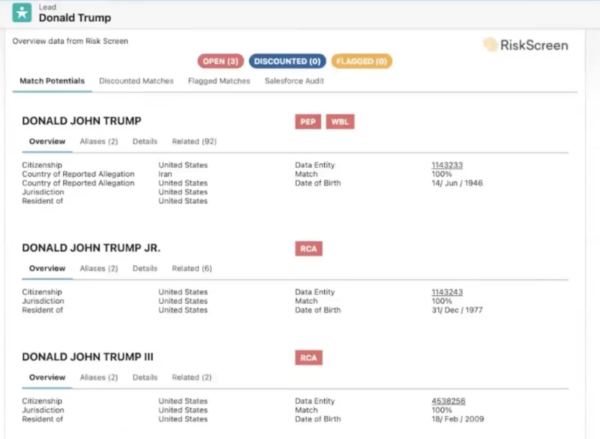

RiskScreen is one such app we use frequently with clients. The app checks databases like Dow Jones and various others to immediately flag if the prospect you are engaging has any sanctions, is on any Wellcheck lists, or is a Politically Exposed Person.

In a recent demo, we used RiskScreen on Home Alone II actor Donald Trump. This is what it showed us:

In this example, we can see everything about Trump, including:

- Any known aliases

- Whether they are politically exposed or a person of special interest

- Roles they’ve had

- Residency details

- Images

- Associated Entities

Importantly, every time a screen happens, a case is created so that you have a full audit history of that individual to ensure their compliance.

In addition to one-off screens, Risk Screen also allows you to do automated screening and batch processing as part of your onboarding workflow.

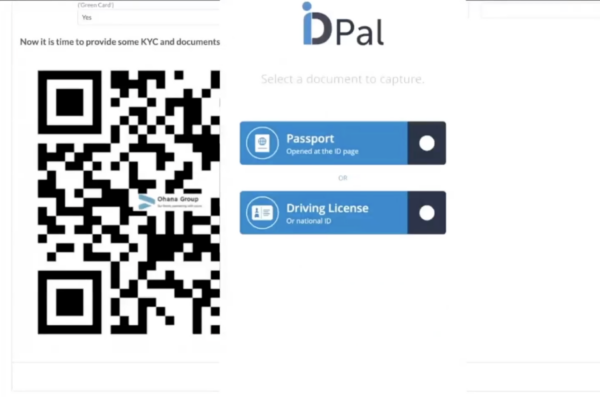

Then there are apps like ID Pal that take due diligence a step further by providing a QR code that new clients can scan using a mobile device. This opens up the ID Pal interface and walks them through the necessary steps to scan documents like passports and take a selfie which the system uses to verify that customer’s identity in real time.

Go with the (Salesforce) Flow

If you had to put a number to every time you’ve filled out a form with your details, what would that number be? One hundred? Five hundred? Five thousand?

It’s often such a tedious task, that it can easily feel like five thousand. This is why the quickest way to ruin any onboarding process is to ask a new client to fill in the same information more than once.

This is where Salesforce Flow comes in.

Flows can be embedded in a Salesforce Experience Cloud portal. What’s unique about Flows is that instead of asking a new client to provide all his information, it leverages Salesforce to display all the information we’ve already collected.

All that’s left for a new client to fill in are the gaps in existing information.

New clients can:

- Easily complete missing information and confirm that information is correct

- Save and come back later, this ensures information doesn’t need to be captured more than once

- Ask questions in real-time, a feature you can enable using Salesforce Service Cloud to embed chatbots and live chat functionality within the portal

Curious to Find Out More?

If you’d like more detail about how you can improve your client onboarding experience, take a look at our latest webinar, “How Salesforce Drives The Client Onboarding Process”.

Key takeaways from the session include:

- Leveraging Salesforce: Explore strategic approaches that maximise the potential of Salesforce within your organisation.

- Financial Services Cloud Deep Dive: Understand the unique features and benefits of Financial Services Cloud tailored for the financial services sector.

- Compliance: Learn how we’re helping businesses accelerate their compliance operations and comply with regulations.

- Success Story: Deep dive into real-world examples of how companies have successfully transformed their operations and client experiences.

- Expert Insights: Gain valuable insights from Comnexa’s experts on best practices and future trends in financial technology.

Incidentally, if you’re looking to improve your onboarding experience for new clients, don’t hesitate to reach out to Phil Cuming – we’d be happy to answer any questions you may have.