- Written by - Phil Cuming

If you’re a private equity or venture capital firm looking to streamline operations & improve efficiency, this blog is a great place to start!

Private Equity and Venture Capital firms are, by their nature, riddled with operational complexity.

Building centralised systems to manage that complexity often has the opposite effect.

This is because the web of contacts, relationships, and referrals is so intricate, and the deal flow is so unique that the one-size-fits-all model that works for industries like insurance and banking won’t cut it.

Loosely speaking, PE and VC firms have similar goals when implementing centralised systems:

- Make more informed decisions by using sophisticated analytics and analytical tools

- Map out relationships using relationship diagrams

- Ensure compliance and security

That’s the dream. The reality is often the polar opposite – systems that partners and directors find convoluted and too time-consuming to be of any use. Manual processes creep in. Information is stored in disparate systems, spreadsheets or inside people’s heads.

Salesforce Financial Services Cloud (SFSC) is being adopted more widely by PE and VC firms thanks to how easily it integrates with other apps, tools and platforms, and how it can be customised to create a 360-degree view of their customers and act as a single source of truth for stakeholders and partners.

So here are the top 3 ways PE and VC firms use Salesforce to improve operational efficiency.

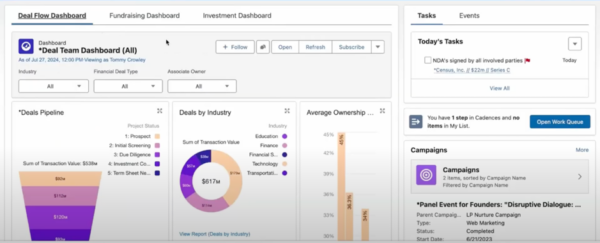

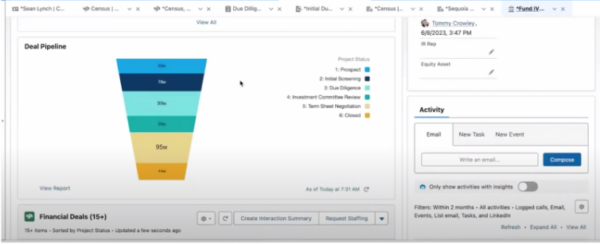

1. Dynamic Dashboards: From Data to Decision-Making

If every business is a technology business, then data plays a critical role in fuelling the engine room of innovation.

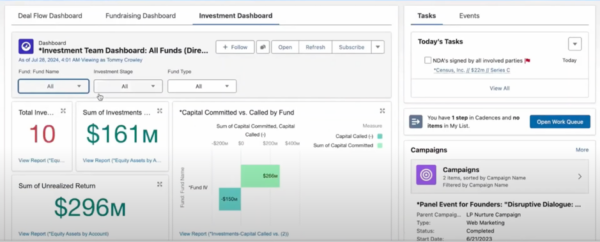

This is especially true for PE and VC firms with multiple stakeholders that need easy access to pipeline data, deals by region, pipeline by fund and a host of other metrics that aren’t always easy to come by. Financial Services Cloud allows users to configure dashboards and display them for a user based on their role within the company.

Examples of this include a customised dashboard for your deals team that shows metrics like:

- Deals pipeline

- Deals by industry

- Average ownership

- Deals by EBITDA range

- Top 5 active deals

- Pipeline by fund

- Deals by region

Or one for your fundraising team or investment team that shows:

- Sum of investments

- Sum of unrealised return

- Capital committed vs called by fund

This can all be designed and defined by your requirements as a business or as an individual team or user.

This ensures that the right people within your PE or VC firm have the right access to the right datasets, which vastly improves overall visibility into business operations and unlocks better decision-making across the business.

2. Driving Event Attendance

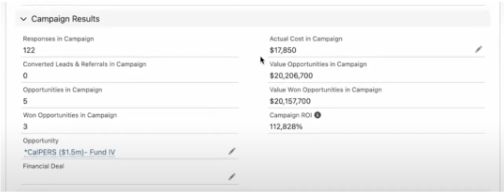

Any marketing event your PE or VC firm invests time and resources into is only as successful as the deals you can generate out the back of it.

Tracking event ROI is often a challenge and is all too often done in spreadsheets or people’s heads.

Salesforce Financial Services Cloud not only solves the challenge of tracking event ROI but can also act as a central platform from which to manage all aspects of the event itself.

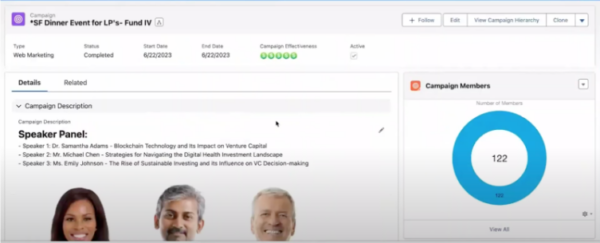

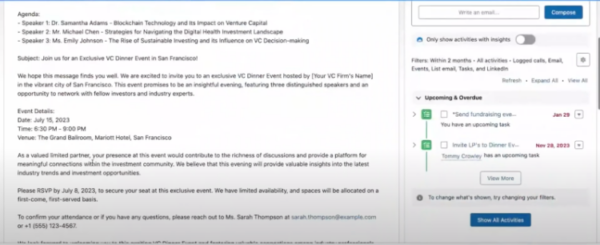

For example, if you have an event that you want to drive attendance to, it will show you campaign information – speaker panel, event details and associated tasks – in order to manage the event all from one platform.

To go back to the point above about proving event-driven ROI, within the campaign, you would also be able to see a dashboard similar to the one below which tracks opportunities won that are associated with the event you hosted.

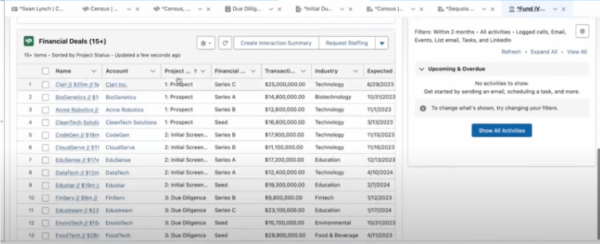

3. From Chaos to Clarity: Tracking Funds with Salesforce

Funds are a way of connecting everything in Salesforce to easily track fund performance.

The way a lot of PE and VC firms do this within Salesforce is by creating a single record that allows them to track all the different activities that happen around a fund.

These include:

- Uncalled / remaining capital

- Equity assets

- Deal pipeline

When you look at the fund record what you want to be able to see are all the deals that are currently in the pipeline. Any deals you are tracking against a particular fund will fall into this deal pipeline report, which would look something like this:

Drill a bit further down and you’ll be able to see all the financial deals, neatly categorised by pre-defined filters:

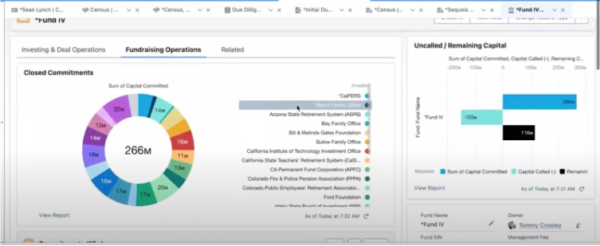

You can also see all the fundraising operations. You can see commitments with fields like:

- Capital committed

- Capital called

- Capital remaining

- Investor type

- Investment number

And of course, opportunity pipeline is another metric you can see at a glance within this dashboard so that you can track which opportunities are tracking against a particular fund.

These are just 3 ways VC and PE firms are leveraging Financial Services Cloud to support the day-to-day. Truth is, the capabilities and benefits of using Financial Services Cloud are endless.

If you’d like to find out more and watch an in-depth demo of Salesforce Financial Services in action, take a look at our recent webinar ‘Unlock the Future of Funding: Transform Your Venture Capital and Private Equity Operations with Salesforce Financial Services Cloud’.

Click below to replay the session and you’ll learn more about how to:

- Streamline your end-to-end process from deal and funding sourcing to exit.

- Utilise advanced analytics for better investment and business development strategies.

- Ensure your operations meet the highest security standards and regulatory requirements.

- Enhance team collaboration and stakeholder engagement while navigating the complexities of stakeholder involvement.

- Understand how Financial Services Cloud can be tailored to grow with your company, offering customisable solutions for your specific needs.

For any questions or if you would like a customised demo reach out to Phil Cuming.